The Simply Solar Illinois Ideas

The Simply Solar Illinois Ideas

Blog Article

Simply Solar Illinois Fundamentals Explained

Table of ContentsFascination About Simply Solar IllinoisHow Simply Solar Illinois can Save You Time, Stress, and Money.The Buzz on Simply Solar IllinoisSee This Report on Simply Solar IllinoisGetting The Simply Solar Illinois To Work

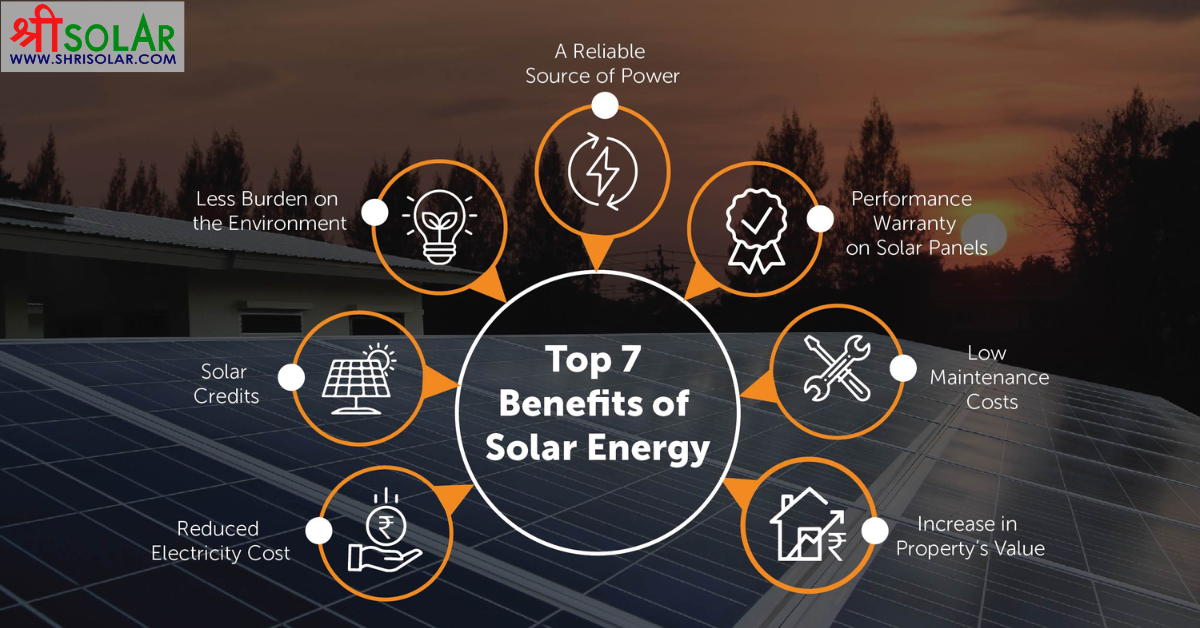

Our team companions with local areas across the Northeast and beyond to provide tidy, inexpensive and reliable power to promote healthy and balanced communities and keep the lights on. A solar or storage space task delivers a number of benefits to the area it offers. As technology developments and the price of solar and storage decline, the economic advantages of going solar remain to climb.Support for pollinator-friendly habitat Habitat remediation on infected websites like brownfields and land fills Much required color for livestock like sheep and poultry "Land banking" for future agricultural use and soil high quality enhancements As a result of environment change, extreme weather is becoming much more frequent and disruptive. As a result, property owners, services, neighborhoods, and utilities are all coming to be increasingly more curious about protecting energy supply services that provide resiliency and energy safety.

Environmental sustainability is an additional essential motorist for businesses buying solar power. Many business have robust sustainability objectives that consist of reducing greenhouse gas discharges and making use of much less resources to help minimize their influence on the native environment. There is an expanding necessity to address climate modification and the stress from customers, is arriving levels of organizations.

The Ultimate Guide To Simply Solar Illinois

As we come close to 2025, the combination of solar panels in commercial tasks is no more just an option but a strategic need. This blogpost explores how solar power works and the multifaceted advantages it gives commercial structures. Photovoltaic panel have been made use of on property structures for several years, however it's only lately that they're ending up being more usual in industrial building and construction.

It can power lights, heating, cooling and water heating in business buildings. The panels can be mounted on rooftops, car parking whole lots and side lawns. In this write-up we talk about just how solar panels job and the benefits of utilizing solar power in industrial structures. Electrical energy prices in the U.S. are raising, making it extra costly for businesses to operate and extra difficult to intend in advance.

The United State Power Information Management anticipates electrical generation from solar to be the leading source of growth in the U.S. power market via completion of 2025, with 79 GW of new solar capacity forecasted to find online over the following 2 years. In the EIA's Short-Term Power Expectation, the firm said it expects renewable power's total share of electricity generation to rise to 26% by the end of 2025

The 45-Second Trick For Simply Solar Illinois

The sunlight causes the silicon cell electrons to propel, developing an electrical current. The photovoltaic solar battery soaks up solar radiation. When the silicon engages with the sun rays, the electrons start to relocate and produce a flow of straight electrical present (DC). The wires feed this DC electricity right into the solar inverter and convert it to alternating power (AC).

There are a number of methods to store solar power: When solar power is fed right into an electrochemical battery, the chemical reaction on the battery components maintains the solar power. In a reverse reaction, the existing departures from the battery storage for intake. Thermal storage uses tools such as molten salt or water to preserve and take in the heat from the sun.

This system shops pressed air in huge vessels informative post such as tanks or natural formations (e.g., caves), after that launches the air to create power. Electricity is just one of the largest recurring expenditures that business structures have. Solar panels substantially decrease energy costs. While the first financial investment can be high, overtime the price of mounting photovoltaic panels is recovered by the money minimized electricity costs.

The Greatest Guide To Simply Solar Illinois

By setting up solar panels, a brand shows that it cares about the environment and is making an effort to reduce its carbon impact. Structures that count totally on find out here now electrical grids are prone to power interruptions that happen during bad weather or electric system breakdowns. Solar panels installed with battery systems allow business structures to remain to function throughout power blackouts.

The Buzz on Simply Solar Illinois

Solar power is one of the cleanest types of energy. In 2024, homeowners can profit from government solar tax incentives, permitting them to counter almost one-third of the purchase rate of a solar system with a 30% tax credit scores.

Report this page